IRS Fresh Start Program

Discover the Fresh Start tax program by the Internal Revenue Service (IRS) – what it does, if you qualify, and how you can receive 100% tax forgiveness.

IRS Fresh Start Program Requirements and Application

The IRS is forgiving millions through the Fresh Start tax program. If you’re struggling to pay an IRS debt, the last thing you’ll want to worry about is extra fees and interest piling up. At IdealTax, we understand the stress you’re dealing with, and this program could be the answer.

Read on for a simplified explanation of the IRS Fresh Start Program to see if you qualify for 100% IRS forgiveness and decide what program is the best for you.

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is designed to help struggling individuals and businesses meet their tax obligations. It includes a series of steps, programs, and policies to help taxpayers reduce their federal tax debt, ease the load, and get back on track financially. If you’re looking to resolve your tax issues, the IRS Fresh Start Initiative may be the right path.

Some benefits include:

More affordable tax payments

Reduced IRS Tax Liens and Levies

Payment Flexibility Under the Fresh Start Initiative

Under this program, you will find a range of flexible solutions to address your IRS debt. Whether you opt for an installment agreement or need more time to settle your taxes without facing penalties, the Fresh Start initiative can offer solutions tailored to your unique needs and financial situation.

Determining which program is best for you can be difficult, especially if you are not familiar with the tax laws and rules surrounding this program and your unique situation. Speaking with a tax professional to determine your eligibility is the best way to move forward.

How Does the IRS Fresh Start Initiative Work?

IRS Fresh Start Program Payment Plan Options

Streamline Installment Plans:

These plans are tailored for taxpayers who need an extended period to pay off their tax debt. Typically, individuals can make payments over an extended duration – often up to 72 months, and in some cases, even up to 84 months. These plans include:

- Short-term payment plan – Available to taxpayers owing less than $100,000 and are able to pay in full within 120 days.

- Long-term payment plan (installment agreement) – Available to those owing $50,000 or less with a repayment period of up to 72 months, dropping to 60 months if you owe $25,000 or less, and a repayment period of 24 months to businesses owing $25,000 or less.

- Extended-term repayment plan – Tax relief firms work with the IRS on your behalf to negotiate an extended repayment plan depending on your income, expenses, and liabilities.

Looking for a tax professional? Our qualified tax attorneys, CPAs, and ex-IRS agents are licensed and ready to help! Get in touch today.

Partial Pay Installment Plans:

Partial Pay Installment Plans are another option for taxpayers struggling to make full payments. They allow you to make smaller, more manageable payments over time. However, it’s important to note that interest and penalties continue to accrue.

How Partial Pay Installment Plans work:

- Taxpayers can significantly reduce their IRS debt by leveraging the statute of limitations – a debt expiration date set by the IRS for when to collect the amount owed.

- Our team of tax professionals will help you maximize this time limit by negotiating for a lower monthly payment and allowing a substantial portion of your debt to expire.

Do I Qualify for the IRS Fresh Start Program?

No matter where you are financially, the IRS offers tax relief solutions to fit your unique situation. Most taxpayers will qualify for some type of relief. You should qualify for the program if you are ready to pay your tax debt through installments over a specific time span and with a decided repayment structure.

Our tax professionals can determine if you qualify for the programs for free. Call now.

General Eligibility for the Fresh Start Initiative

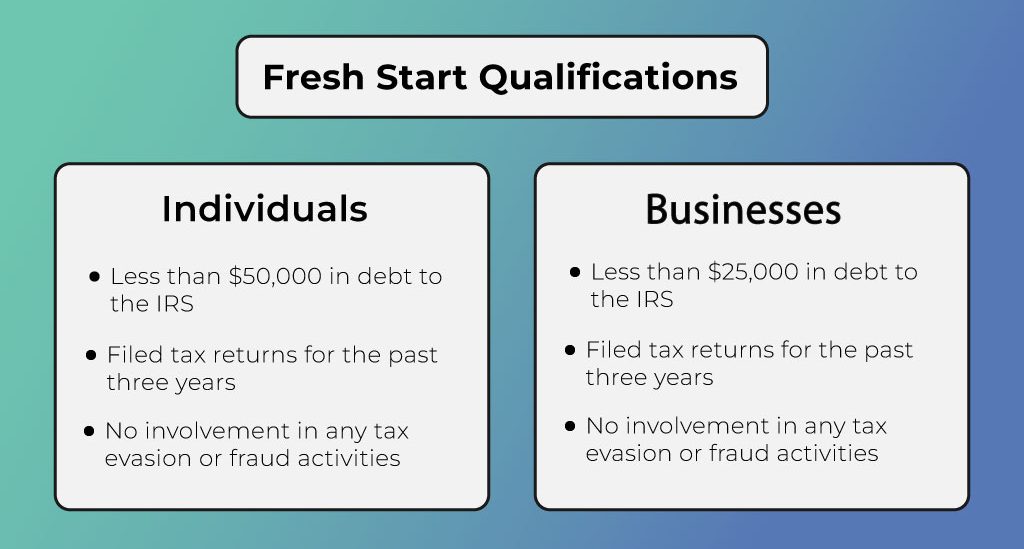

Before you apply, make sure you’re eligible for the program. These are some essential criteria:

- A 25% decrease in income if you are a sole proprietor.

- Tax debt less than $50,000 including interest and penalties.

- A clean record with zero missed delinquent payments to the IRS.

Some other requirements include having filed tax returns for the past three years, no involvement in any tax evasion or fraud activities, and an agreement to pay your debt within six years.

Owe more than $50,000 in back taxes? We can help with that. Reach out to one of our licensed tax professionals for expert advice.

What If You Can’t Afford a Payment Plan?

In some cases, a standard payment plan may remain out of reach. The IRS Fresh Start Program includes alternative solutions:

Offer in Compromise (OIC):

If you’re unable to meet the requirements of a traditional payment plan, Offer in Compromise (OIC) could be the right path for you and lead you to tax debt freedom. Offer in Compromise allows you to settle your tax debt for less than the full amount owed.

How Offer in Compromise works:

- You must demonstrate that paying the full amount would create a financial hardship.

- The IRS will evaluate your financial situation, and if you qualify, a non-refundable deposit is required, typically 20% of your offer amount.

Currently Non-Collectible Status:

If making any payments on your tax debt seems impossible due to severe financial limitations, Currently Non-Collectible Status may be the right plan for you.

How Currently Non-Collectible Status works:

- You will need to demonstrate that paying the full amount would put a serious financial strain on you.

- Under this status, the IRS temporarily halts debt collection until your financial situation improves.

Penalty Abatement:

Penalty Abatement helps those struggling to pay taxes on time with penalties piling up. If you qualify, it could help waive certain penalties associated with your tax debt.

How Penalty Abatement works:

- You will need to provide a valid reason for your inability to pay on time.

- The IRS will consider your request. Some valid reasons include serious illness, relying on bad advice or guidance from a tax professional or software, and other exceptional circumstances.

Applying for the IRS Fresh Start Initiative

Get started with your application online by filling out our contact form and see if you qualify. Although the application process varies depending on the program, you will most likely have to complete certain forms and submit them with specific documents.

We’ll work with you to complete your application and gather the required evidence to demonstrate financial hardship – such as medical statements or insurance claims. We submit it to the IRS for you and ensure you’re on track for a successful application.

Reducing your tax debt with IdealTax

Curious about your chances of getting accepted under the Fresh Start Tax Program? Reach out to us today to explore your prospects and what this powerful program can do for you.

Our diverse team includes tax attorneys, federally licensed enrolled agents, and skilled accountants. They deal with hundreds of cases each month, helping those behind on IRS tax filing. These are a few recent victories we’ve had with our clients:

Clients’ Success Stories

Khan’s 400k Transformation

Zorida’s Financial Journey from Burden to Balance

Zorida was hoping for an immediate solution to the $251,000 tax debt and $3,500 monthly payments. We successfully found a significant turnaround through the IRS Fresh Start Program – with Zorida’s debt lightened to a more manageable $35,000 and monthly payments of $525.

Ronald’s Case: $40k Burden Eased

Ronald faced $40,000 of tax debt to the IRS. Through careful negotiations and strategic interventions, our team managed to settle Ronald’s debt for a monthly payment of $555 through the IRS Fresh Start Program.

For over 13 years, IdealTax has been in the service for those dealing with financial and tax issues. Our professional team will help you get the best results and act as a buffer between you and the IRS so you can focus on what’s most important to you and your life.

Whether you’re grappling with substantial debt or seeking a second chance for financial stability, the IRS Fresh Start Program could be the solution you need to embark on a path toward a brighter financial future. Reach out get a free tax consultation today!

IRS Fresh Start Initiative FAQs

Can Any Taxpayer Apply for the IRS Fresh Start Initiative?

Most do, but you’ll need to owe back taxes! Call now to speak with a tax professional and see if you qualify for the programs for free.

What Debts Are Covered with the IRS Fresh Start Initiative?

When to Consider the Fresh Start Program

Will There Be a Penalty for Using the Fresh Start Program?

Is the IRS Fresh Start Program legit?

It is! We have years of experience in helping our clients find freedom from tax debt through Fresh Start Initiatives. Call us today and discover what relief is available for you